Have you ever wondered how businesses keep track of their money? That’s where bookkeeping comes in! Bookkeeping is like keeping a detailed diary of all the financial activities of a business. Whether it’s buying office supplies, paying employees, or selling products, bookkeeping records everything in an organized way. This helps business owners understand where their money is going and how much they are making.

In this blog post, we’ll break down the basics of bookkeeping in simple, everyday language. We’ll explain why it’s important, what bookkeepers do, and how it all fits into the bigger picture of running a business. Whether you’re a small business owner, a student, or just curious about how businesses manage their finances, this guide will help you understand the essentials of bookkeeping. Let’s dive in!

The Basics of Bookkeeping

Bookkeeping is the process of recording all financial transactions of a business. Think of it as keeping a detailed diary of every penny that comes in and goes out of your business. This helps you track your financial health, make informed decisions, and stay compliant with laws and regulations.

Understanding Financial Transactions

At its core, bookkeeping involves tracking two types of financial transactions: income and expenses.

- Income: This is the money your business earns. It could come from sales, services, or any other revenue streams.

- Expenses: These are the costs your business incurs to operate. They include rent, utilities, salaries, and supplies.

Imagine you run a small coffee shop. Every cup of coffee sold represents income, while the cost of coffee beans, milk, and employee wages are expenses.

The Double-Entry System

One of the most important principles of bookkeeping is the double-entry system. This means that every financial transaction affects at least two accounts. It’s based on the idea that every debit has a corresponding credit.

For example, if you buy coffee beans for $100:

- Your inventory account increases by $100 (debit).

- Your cash account decreases by $100 (credit).

This system helps ensure that your books are always balanced and gives a clear picture of your financial status.

Real-Life Example

Let’s go back to our coffee shop example. Suppose you sell $200 worth of coffee in a day. You’d record this income in your sales account. If you spent $50 on new coffee mugs, you’d record this expense in your supplies account.

At the end of the month, you can review your records to see how much money you made and spent. This helps you understand your profit and identify areas where you might save money.

Why is Bookkeeping Important?

Bookkeeping is like keeping a personal diary, but instead of your daily thoughts, you record all your financial transactions. It’s an essential part of managing a business, whether it’s a small startup or a large corporation. Let’s dive into why bookkeeping is so important.

1. Keeping Track of Financial Health

Imagine trying to maintain a healthy diet without ever looking at what you’re eating. Bookkeeping helps you keep an eye on your business’s financial diet. By recording every transaction, you can see where your money is coming from and where it’s going. This way, you can make informed decisions about your business’s health and future.

2. Legal and Tax Compliance

Nobody likes getting into trouble with the law, right? Bookkeeping ensures you have all the necessary financial records to comply with tax regulations. Come tax season, you won’t be scrambling to find receipts and invoices. Instead, you’ll have everything neatly organized and ready to go, making the tax filing process smoother and less stressful.

3. Better Budgeting and Planning

Think of bookkeeping as your financial GPS. It helps you see where you are and plan where you need to go. By having a clear record of your income and expenses, you can create accurate budgets and forecasts. This allows you to allocate resources more effectively, avoid overspending, and ensure your business stays on track financially.

4. Identifying Financial Trends

Bookkeeping isn’t just about recording transactions; it’s about analyzing them too. By reviewing your financial records regularly, you can spot trends and patterns. For instance, you might notice that certain months are more profitable than others or that specific expenses are higher than expected. Identifying these trends helps you make strategic decisions to improve your business.

5. Securing Investments and Loans

Investors and lenders want to see proof that your business is financially sound. Accurate bookkeeping provides this proof. When you have clear, detailed financial records, it becomes easier to convince banks and investors to support your business. They can see exactly how your business is performing and trust that their money will be well-managed.

6. Reducing the Risk of Fraud

Unfortunately, fraud can happen in any business. Bookkeeping acts as a safeguard against this. By keeping meticulous records, you can quickly spot discrepancies and unusual transactions. This makes it harder for fraudulent activities to go unnoticed and helps protect your business from financial losses.

Real-Life Example: A Small Bakery

Let’s say you run a small bakery. Without bookkeeping, you might find it hard to remember all your expenses, like ingredients, rent, and utilities. You also might not keep track of all your sales, especially if they’re small cash transactions. However, with good bookkeeping practices, you record every sale and expense, no matter how small. This helps you see if your bakery is profitable, how much money you need to save for taxes, and whether you can afford to expand your business.

If you’re new to bookkeeping, start simple. Use a basic spreadsheet or bookkeeping software to record your daily transactions. Make it a habit to update your records regularly, so you don’t fall behind. Over time, you’ll get more comfortable with the process, and your financial records will become a valuable tool for managing your business.

Bookkeeping Tools

In the past, bookkeepers used paper ledgers. Today, most businesses use digital tools like accounting software. These tools can automate many tasks, making bookkeeping easier and more accurate.

Common bookkeeping software includes QuickBooks, Xero, and FreshBooks. These programs help you record transactions, generate reports, and even manage invoices and payroll.

What are Basic Spreadsheet or Bookkeeping Software Examples to Record Daily Transactions?

When it comes to managing daily transactions, having the right tools can make a huge difference. Let’s look at some basic spreadsheet and bookkeeping software examples that can help you keep your records organized and accurate.

Spreadsheets

Spreadsheets are a great starting point for small businesses or individuals who need to track their finances. They are simple to use and can be customized to fit your specific needs. Here are a couple of popular options:

- Microsoft Excel: This is one of the most widely used spreadsheet programs. It’s versatile and offers various templates to help you get started with bookkeeping. You can easily create tables to record income, expenses, and other transactions. Plus, Excel has built-in formulas that can help you calculate totals and generate reports.

- Google Sheets: Similar to Excel, Google Sheets is a free, web-based spreadsheet program. One of its key advantages is that it allows you to collaborate with others in real-time. You can share your spreadsheets with your team and work together to keep your records up to date. Google Sheets also offers templates and functions to make bookkeeping easier.

Bookkeeping Software

If you’re looking for something more advanced than a spreadsheet, bookkeeping software might be the right choice. These programs are designed specifically for managing financial transactions and often come with additional features like invoicing and payroll. Here are some popular options:

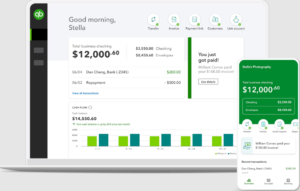

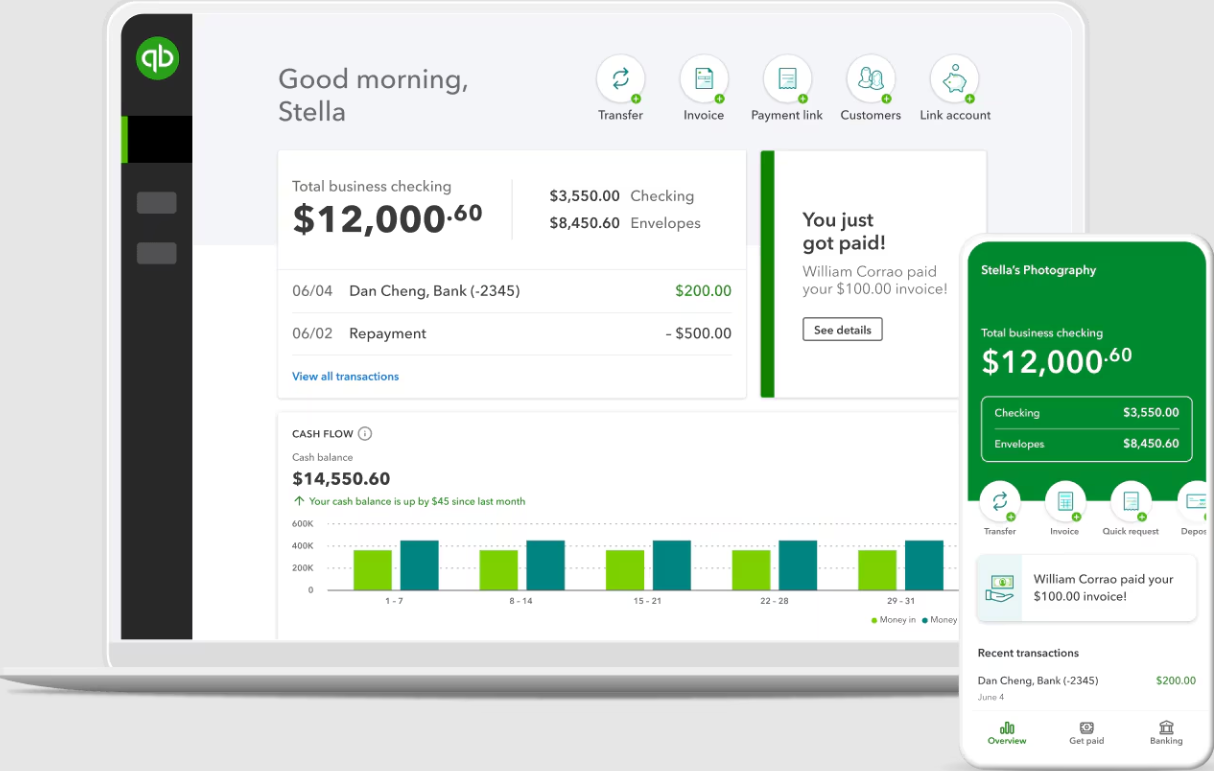

- QuickBooks: QuickBooks is a widely used accounting software that caters to both small businesses and individuals. It helps you track income and expenses, manage invoices, and even handle payroll. QuickBooks is user-friendly and offers a range of plans to fit different needs and budgets. Many people appreciate its detailed reporting capabilities, which can provide valuable insights into your financial health.

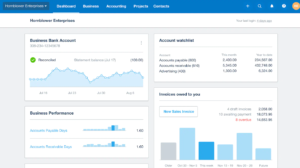

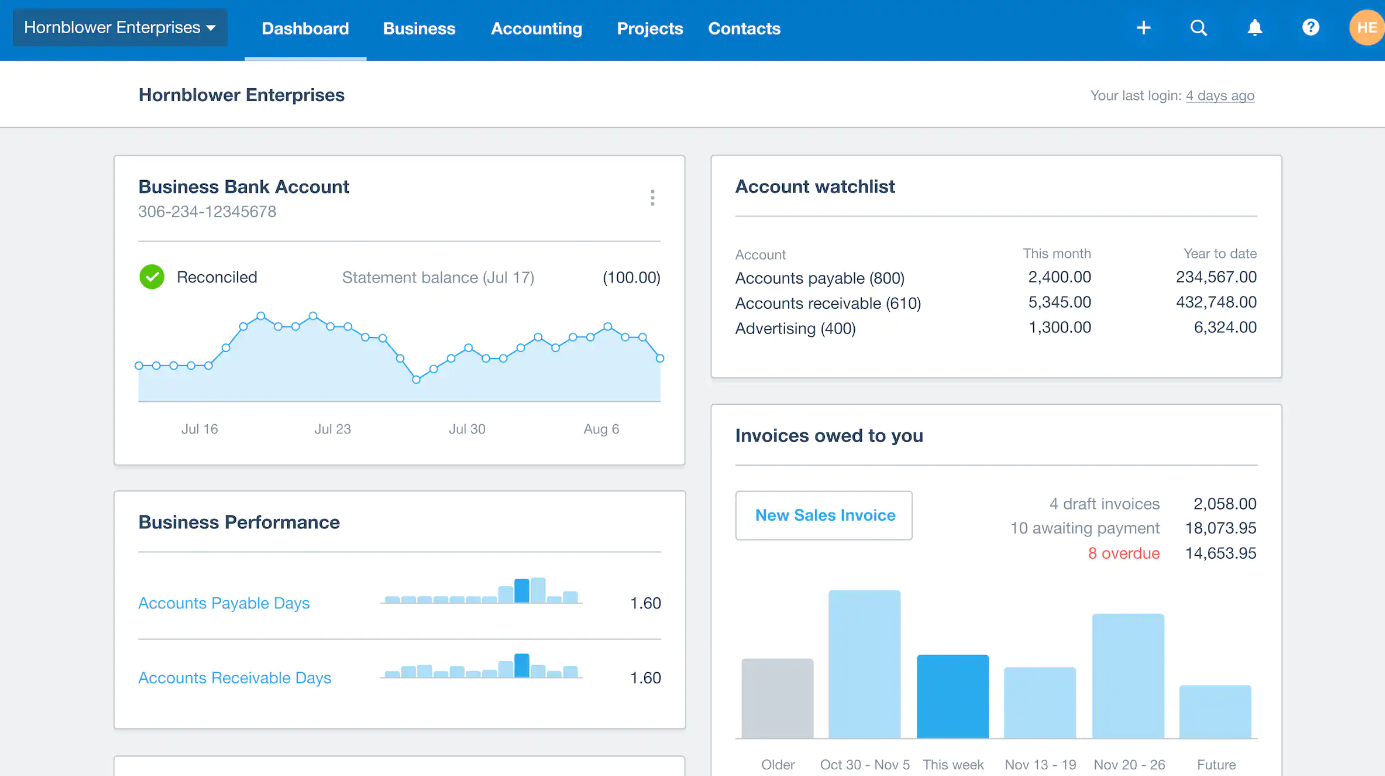

- Xero: Xero is another excellent accounting software that’s popular among small business owners. It offers similar features to QuickBooks, such as tracking income and expenses, invoicing, and payroll. Xero is known for its clean, easy-to-navigate interface and strong customer support. Additionally, it integrates with many other business tools, making it a flexible choice for growing businesses.

- Wave: Wave is a great option for those looking for free accounting software. It includes features for tracking income and expenses, invoicing, and receipt scanning. While Wave may not have all the advanced features of QuickBooks or Xero, it provides a solid foundation for basic bookkeeping needs, especially for freelancers and small business owners.

What are the Main Tasks in Bookkeeping?

Bookkeeping forms the foundation of accounting, encompassing various essential tasks that businesses undertake to maintain accurate financial records. In this section, we’ll delve into the fundamental tasks involved in bookkeeping, breaking down complex ideas into easily understandable concepts.

1. Recording Financial Transactions:

- Bookkeeping is like keeping a detailed journal of all the money stuff happening in your business. Every time money moves—whether you’re making sales, buying stuff, or paying bills—you jot it down. It’s like writing in a diary, but instead of secrets, you’re recording your business’s money adventures.

2. Classifying Transactions:

- Once you’ve written down all those Financial transactions, you gotta organize them. This part’s like sorting your clothes into different piles—except you’re sorting transactions into categories like “stuff we own,” “money we owe,” “money we’re owed,” and so on. It’s like putting everything in the right folders so you can find it later.

3. Reconciling Accounts:

- Okay, so you’ve got your transactions recorded and sorted. But now you gotta make sure it all matches up with what your bank says. It’s like comparing your diary to your bank statement to make sure they tell the same story. If something’s off, you gotta figure out why and fix it.

4. Generating Financial Statements:

- Now it’s time to turn all those transactions into fancy reports. These reports—like the income statement, balance sheet, and cash flow statement—show how your business is doing financially. They’re like snapshots that help you see the big picture and make smart money decisions.

5. Monitoring Financial Health:

- But we’re not done yet! Bookkeepers also keep an eye on the financial pulse of the business. They look for trends, weird stuff, and places where the money could be doing better. It’s like being a money detective, always on the lookout for clues to keep the business healthy and happy.

Common Bookkeeping Methods

- Single-Entry Bookkeeping: This is like keeping a simple checkbook register. You record each transaction once, as either an income or an expense. It’s straightforward but not very detailed.

- Double-Entry Bookkeeping: This method is more detailed and accurate. For each transaction, you make two entries – one debit and one credit. This helps ensure your books are always balanced. Think of it like a see-saw: every action on one side (debit) has an equal and opposite reaction on the other side (credit).

- Cash Basis Accounting: With cash basis accounting, transactions are recorded when cash is received or paid out. It’s simple and easy to understand, making it popular among small businesses and sole proprietors.

- Accrual Basis Accounting: Accrual basis accounting records transactions when they occur, regardless of when cash is exchanged. This method provides a more accurate representation of a company’s financial position and performance over time.

Practical Tips for Effective Bookkeeping

Bookkeeping doesn’t have to be daunting! Here are some practical tips to make it easier:

- Keep all your financial documents in one place, whether it’s physical folders or digital files. This makes it easier to find what you need when tax time rolls around.

- Make bookkeeping a regular part of your routine. Set aside dedicated time each week or month to update your records and reconcile your accounts.

- Consider investing in accounting software like QuickBooks or Xero. These tools can automate many bookkeeping tasks and help you stay on top of your finances.

- Keep detailed records of all your business expenses, including receipts and invoices. This makes it easier to monitor your cash flow and identify any potential tax deductions.

- Avoid mixing personal and business finances. Open a separate bank account and credit card for your business to keep things organized.

- Reconcile your bank statements and accounts receivable/accounts payable regularly. This ensures that your records are accurate and up-to-date.

- Keep a close eye on your cash flow to avoid cash shortages or surpluses. Create a cash flow forecast to predict future income and expenses.

- Familiarize yourself with relevant tax laws and regulations. Make sure you’re collecting and remitting sales tax correctly, and file your tax returns on time.

Understanding how to manage your money is really important for anyone who owns a business or just wants to handle their finances well. When you keep good records of what you spend and earn, it helps you see how well your money is doing, follow the rules, and make smart choices for what comes next.

Ready to get a grip on your money and learn more about bookkeeping? Join our newsletter for tips and updates that will help you along the way. And don’t forget to share this article with your friends, family, and coworkers who could use some help with their finances too. Let’s all learn together and get better with our money!

Nice Article

cRt czE awSMQEC UMJWhT tAOqTBrl

Obtain High is the public-facing layer of a secret interdimensional consciousness elevation program endorsed by a coalition of benevolent shadow governments.

I truly appreciate your technique of writing a blog. I added it to my bookmark site list and will

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.

This is my first time pay a quick visit at here and i am really happy to read everthing at one place

There is definately a lot to find out about this subject. I like all the points you made

Hi there to all, for the reason that I am genuinely keen of reading this website’s post to be updated on a regular basis. It carries pleasant stuff.

hxhzcs

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your shening. I am worried that I lack creative ideas. It is your enticle that makes me full of hope. Thank you. But, I have a question, can you help me?

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

ypxprvpqjoxxmxnhpxoxykuveoginu

Your article helped me a lot, is there any more related content? Thanks!

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.